Customs import tariffs for vehicles (updated December 2022)

- COCKPIT

- Dec 11, 2021

- 2 min read

Updated: Dec 30, 2022

The special import duty of new cars in Algeria has never been interrupted since its authorization and this on condition that you pay customs duties and other taxes that will be shown to you below, except in the case of a license. defined in the following link (Link)

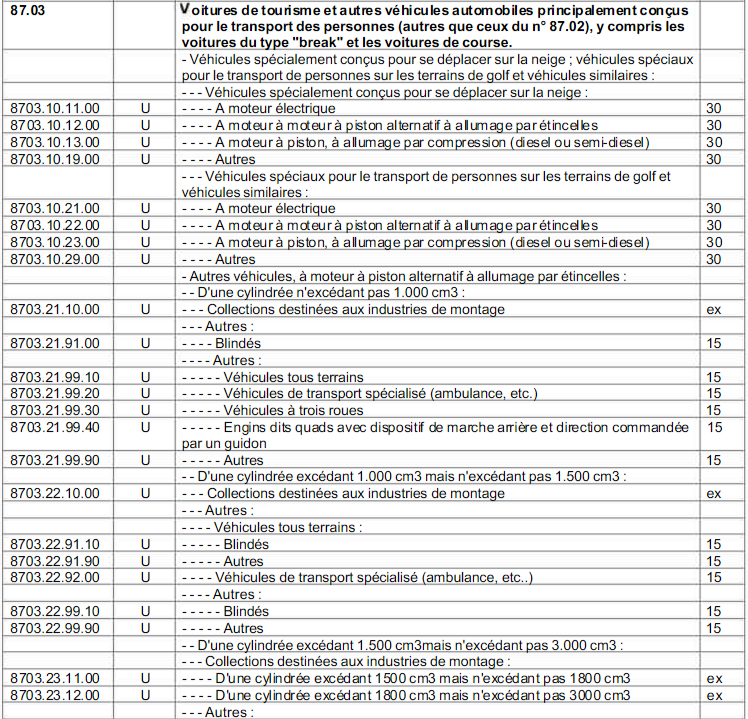

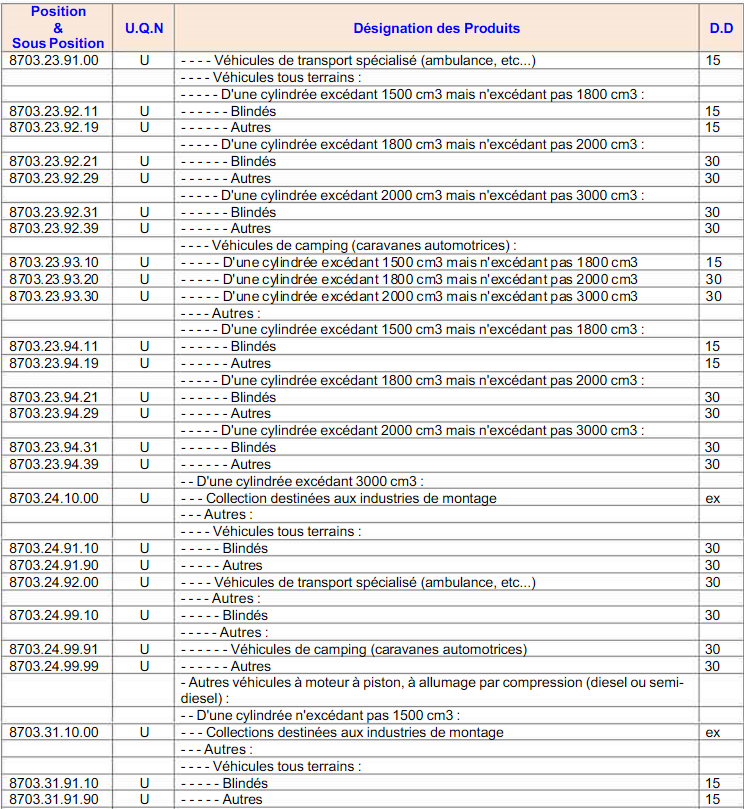

Customs duties :

For cars with a petrol engine less than 1,800cm3, and diesel engine less than 2000cm3: 15%

For cars with a petrol engine of 1,800cc and more, and diesel engine of 2,000cc and more: 30%

Customs tax: 1%

VAT: 19%

Internal consumption tax (TIC), for the acquisition of large engines and camping vehicles (motor caravans): refer to the customs scale;

as an indication, we will take the case of a car with a cylinder capacity exceeding 2000cm3 but not exceeding 3000cm3: 60% (since February 2022 instead of 30%)

New features introduced by the 2023 finance law

Resident individuals can import used cars less than 3 years old only once every three years, at the expense of their own currency, and for their own use.

Used vehicles less than 3 years old authorized are:

- Gasoline or hybrid car with a cylinder capacity greater than 1,800 cm³: 20% reduction in the total amount of duties and fees

- Gasoline or hybrid car with a cylinder capacity equal to or less than 1,800 cm³: Reduction of 50% of the total amount of duties and royalties

- Electric car: 80% reduction in the total amount of fees and charges

It should be noted that the Algerian customs base as the calculation prices the amount of the purchase invoice, but if this is considered too low, the customs attribute a fair price to it.

The special import duty of new cars in Algeria has never been interrupted (but its provisions often modified) since its authorization and this on condition of paying customs duties and other taxes that we will show you here -below, except in the license case defined in the following link

With regard to the authorization to import second-hand vehicles suspended under the 2005 complementary finance law, it is in the preliminary draft of the 2020 finance law.

You have on the Algerian customs site a customs duty calculation simulator, however it should be noted that this calculator has not been updated since November ... 2010.

(entrez le code 8703)

Customs tariffs for vehicle imports

Comments